FLORIDA EMPLOYERS ARE REQUIRED TO REPORT ALL NEW HIRES AND MORE

By: Christina Harris Schwinn, Esq.

Why are employers required to report newly hired (rehired) employees and independent contractors? The obvious reason is so that the State of Florida can determine whether unemployment taxes are being paid on the wages paid to the employees. There is another reason that many employers are not aware of, i.e., enforcement of child support orders. The reporting of newly hired or rehired employees creates a depository of information that assists the Department of Revenue Child Support Program (“Program”) to ensure that child support obligations are timely paid. How? Simply put, if the Program has a child support order on file it can match it up to its databases of employers and employees and then it can facilitate and direct the collection of child support payments. Child support obligations are legal obligations of the parent, but, note that the collection and payment thereof becomes the obligation of the employer paying wages to an employee once the employer receives written notice of a child support order. Do not ignore a child support order—or any other wage garnishment order for that matter. Why? Because ignoring such orders could lead to financial liability for the employer. If an employer fails to comply with the child support or garnishment order, the employer can be strictly liable for the payments that the employer failed to withhold from the garnished employee’s wages.

Why does the new law include the reporting of payments to independent contractors of $600 or more? First, note that the requirement does not include independent contractor relationships with true businesses. The law is targeted towards identifying misclassified individual independent contractors who should have been treated as an employee to begin with, not as an independent contractor. The reporting requirement is triggered as of the hire date of either the employee or the independent contractor and submission of the report is required within 20 days.

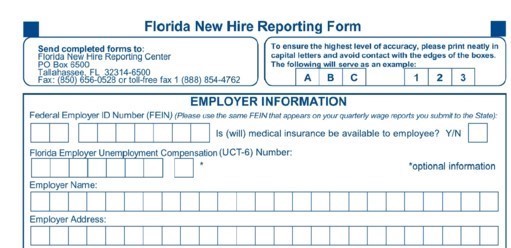

As of October 1, 2021, the new hire reporting requirements were extended to cover all employers employing employees regardless of the number of employees employed. Employing one employee triggers the reporting requirement. The law also requires employers or any business entity to report any payment to an independent contractor of $600 or more.

Now is a good time for businesses that have no employees on the payroll and employers to review their pay practices for employees and independent contractors to ensure compliance with these new reporting requirements for new hires. If your business contracts with a payroll service or professional employer organization, be sure to inquire about how the company ensures compliance with the new hire reporting requirements. Caution! Don’t forget about independent contractors. Unless your company has specifically contracted with its payroll processing service or other service provider specifically for the processing of payments to independent contractors, do not assume that the information regarding them is being reported.

New hiring reporting is the law and all businesses/employers must comply with the reporting requirements—this is a given. Should an employee or independent contractor terminations be timely reported to the State of Florida? Absolutely. Failure to do so could result in financial liability to you or your company.

For more information on the new hire/independent contractor reporting requirements, click here: https://servicesforemployers.floridarevenue.com/Pages/home.aspx.

A note to the reader: This article is intended to provide general information and is not intended to be a substitute for competent legal advice. Competent legal counsel should be consulted if you have questions regarding compliance with the law.

Questions regarding the content of this article may be e-mailed to Christina Harris Schwinn at christinaschwinn@paveselaw.com. Ms. Schwinn is a partner and an experienced employment and real estate attorney with the Pavese Law Firm, 1833 Hendry Street, Fort Myers, FL 33901; Telephone: (239) 336-6228; Fax: (239) 332-2243. To view past articles written by Ms. Schwinn please visit the firm’s website at www.paveselaw.com.